HOW WE CAN HELP WITH

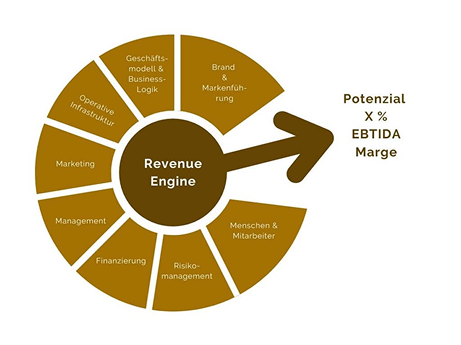

how to We provide guidance on how to find investors and how to approach investors to secure funding. We assess the readiness of your business for investment and advise on the documents you should prepare in advance. Our expertise extends to negotiation tactics, guiding you through the typical aspects of a negotiation and what to avoid. Konsultori assists in determining the valuation of your company and helps you demonstrate its value to potential investors.

Book a non-binding consultation

Financial plan and investment teaser

Business valuation and project management

List of investors and negotiation support

Coordination of legal consultants and auditor

We specialise in business valuations for early-stage startups. At this stage, the future growth of your business is still highly uncertain, requiring special methods for valuations. Methods to appraise early-stage businesses use the DCF method as standard, combined with a multiples approach. Sometimes, an asset valuation is also necessary.

In the service industries and technology sector especially (platform model, SaaS model, corporate sales), we have several years of experience and provide templates for financial planning which are challenged using benchmarks.

Investors need a few solid arguments to explain why your business generates added value and why your business valuation is forecast to increase exponentially in the future. That is summarised in an equity story and together with your investment teaser, it is the backbone of your investment story.

We support business sales and funding rounds with strategic or financial investors. Depending on your industry, different processes need to be defined in order to be able to manage and complete the process within the scheduled timeframe.

With 3+ years M&A experience in the corporate and startup scene, project management and keeping tight deadlines in mind is second nature to us. Assisting our clients with briefing and debriefing on future procedures during the negotiation process is also nothing new to us.

A good network can definitely be beneficial. But these days you can approach investors and strategic partners with a short, well-crafted ‘cold’ pitch. We don’t believe that you need to approach business matchmakers for the sake of your network.

We engage in a thorough discussion to understand your specific needs, goals, timeline, budget, and general project requirements.

We give feedback on everything you already have and provide you with frameworks, templates, and inputs to the list of things to prepare for investor processes, from financial to strategy documentation, pitch-deck, etc. We provide benchmarks, look at inconsistencies, assess your business from an objective perspective, advise on KPIs.

We use different methods suitable for your situation to come up with your company valuation, a presentation of it including all the details and benchmarks and argumentation to defend your valuation in talks.

We support you in preparing your documentation including a revision of your pitch deck including all elements, being consistent, benchmarked, defendable, state of the art, readable.

We extend your existing list of potential investors by working on a clear investor profiling and ranking and providing more sources to build your list of investors. We jointly cut it down to a short list and prioritise

We assume project management and coordination responsibilities during the whole process, give feedback, keep time management, brief and debrief for negotiations.