HOW WE CAN HELP WITH

Understanding the value of your company is essential for making informed decisions and achieving strategic goals. Our business valuation service is tailored to startups and SMEs, providing expert guidance to help you navigate key moments such as attracting investors, forming strategic partnerships, onboarding new co-founders, or preparing for a sale. With extensive experience in company valuation, we specialize in delivering robust and well-benchmarked valuations that serve as a foundation for successful negotiations with investors, partners, and acquirers. Whether you need a startup valuation to secure funding or an SME valuation to explore growth opportunities, our team of business valuation experts ensures precision and credibility at every step. By leveraging proven methodologies and industry benchmarks, we offer insights that empower you to make confident decisions and maximize your business’s potential.

Book a non-binding consultation

Company Valuation report

Business Valuation methods explained

Benchmarking

Feedback on financial planning

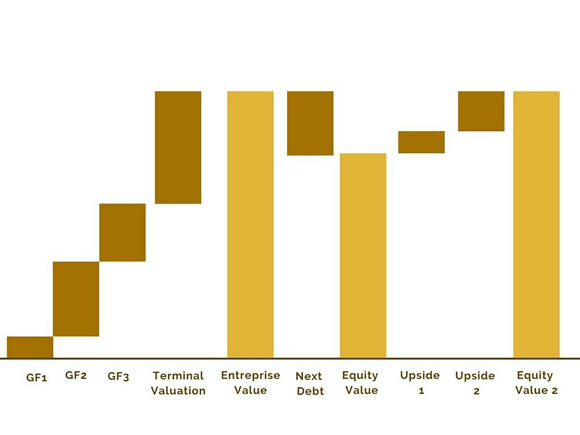

We specialise in business valuations for early-stage startups. At this stage, the future growth of your business is still highly uncertain, meaning special methods for company valuation must be applied. Late-stage businesses use the DCF company valuation method as standard, combined with a multiples approach. Sometimes, an asset valuation is also necessary.

In the service industries and technology sector especially (platform model, SaaS model, corporate sales), we have several years of experience and provide templates for financial planning which are challenged using benchmarks. This is the base for your company valuation.

In 2022 Startup advisory became a certified international, cross-border transfer consultant under the EU project DANAE “Advisors in a Novel SME Transfer”

We have been active in the M&A sector for over 3 years (acquisition and sale of businesses and business shares), thus we have run a multitude of company valuation projects.

We engage in a thorough discussion to understand your specific needs, goals, timeline, budget, and general project requirements.

We challenge your financial planning which is used for the business valuation, factoring in going concern assumptions and a holistic analysis of opportunities and risks. We normalise certain aspects of your financial planning.

We create a working capital and cash-flow analysis and benchmark your financial plans.

We work with you to create 2-3 scenarios for your business. This serves as a basis for the company valuation calculation.

We benchmark your financial plan and valuation to provide enough outside perspective to the valuation results. This is the basis for the argumentation of the value of the company.

We create a business valuation report containing the information collected from the past, the drivers and assumptions for the financial planning and the metrics and methods for the business valuation, as well as the results.

We advise on structuring outreach and manage the sales process on the customer’s behalf if needed.

During the exit process we support on negotiation and conversations with the different parties.